Summarize this content to 2000 words in 6 paragraphs in Arabic

Optimum pulled the plug on MSG shortly after confetti rained down on Times Square to ring in 2025 – and Knicks and Rangers fans could be left in the dark well into the new year, The Post has learned.

The breakdown in talks over a new contract with MSG Networks, which expired at midnight Tuesday, is part of a wider retrenchment by cable operators looking to slash the high prices demanded by regional sports networks, or RSNs.

The two sides remain far apart in the high-stakes negotiations that have major implications for both companies, sources close to the situation told The Post.

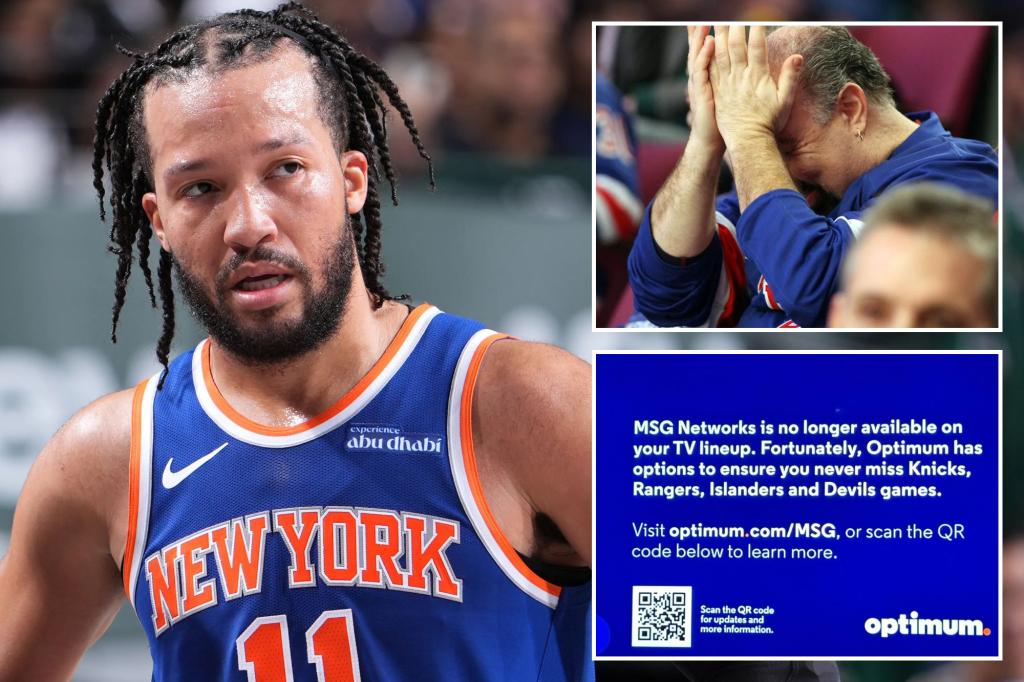

On Wednesday, Optimum subscribers flipping to MSG – which also broadcasts Islanders and Devils games – were greeted with a blue screen telling them: “MSG Networks is no longer available on your TV lineup.”

The Altice-owned cable operator went on to tout a QR code and a web address that offer “options to ensure” they don’t miss any Knicks, Rangers, Islanders or Devils action.

That option is a 30% discount if they subscribe to the streaming service Fubo, which carries MSG Networks, as long as they keep Optimum’s internet service.

The blackout immediately impacted Devils and Knicks games scheduled on New Year’s Day.

Optimum also issued a scathing message Wednesday aimed at MSGN, which is led by Knicks and Rangers owner James Dolan.

“MSG Networks demanded that we pay an exorbitant amount in fees to be able to carry its content and that customers who don’t want the content – who are the majority – have to pay for it anyway,” Optimum said.

“Despite this, Optimum offered to absorb their egregious price demands if we could package MSG Networks in a way that would give more flexibility and control to our customers. … MSG Networks said no and refused multiple offers from us to reach a deal.”

MSGN issued a rebuttal in its own New Year’s Day statement.

“This is a pure and simple price gauge from Altice,” MSG Networks said.

“We offered Altice a number of fair and reasonable proposals that called for Altice to pay us less than last year. Altice rejected all of them, including our offer to keep MSG Networks on the air while we continued to try to reach a deal. We remain ready to negotiate in good faith.”

In an odd bit of irony, the Knicks owner is feuding with the company founded in 1973 by his dad, cable pioneer Charles Dolan, and then called Cablevision. It was sold, along with the Optimum brand, to European telecom giant Altice for $17.7 billion in 2016. Charles Dolan died last weekend at age 98.

Optimum subscribers, meanwhile, were furious over losing access to their beloved teams.

“I really don’t care whose fault it is now that MSG has gone dark on Optimum,” Lou Panico of Manalapan, NJ fumed. “As usual the consumer is caught in the middle between two greedy, dishonest entities.”

MSGN was willing to move from the basic Optimum tier where it was getting a roughly $10-per-subscriber fee in 2024, according to a source close to the negotiations.

That’s about the same rate that national sports giant ESPN charges cable companies.

The move from basic cable to a premiere tier could hit debt-saddled MSGN’s bottom line by as much as 50%, since the majority of Optimum’s roughly 1 million subscribers in the New York City area would no longer pay for the channel, an RSN executive working for another network told The Post.

Optimum does face the risk also of losing subscribers to rival cable companies like Charter Communications and Verizon’s Fios, which has a deal to carry MSG on basic cable.

Dolan recently negotiated a new deal with a major New York-area cable company in which it was moved off the basic tier and accepted lower overall revenue in return for a longer pact, two sources familiar with the negotiations said.

However, Optimum is the only cable option in large swathes of the city, and once the hard-core sports fans jump ship it may be in no hurry to return to the negotiating table, a source said.

Altice could decide to play hardball and threaten to drop the channel to extract better terms from MSGN.

“When you drop an RSN, you lose about 5% of your customers but your revenue increases nearly 20% since you save money by not paying for that channel,” the RSN executive said.

The impasse could exacerbate the overall trend of cord-cutting that has eaten away at cable’s dominance over the past decade.

In 2023, MSGN Networks launched a streaming service priced at $29.99 a month. Last year, it teamed with the YES Network, home of the Yankees and Nets, on the Gotham Sports app, which costs $41.99 a month if one combines YES and MSG. Customers can still just get MSG for $29.99.

MSGN has been in a protracted standoff with Comcast for more than two years, impacting subscribers in New Jersey and Connecticut.

But an extended fight with Optimum could force MSGN into bankruptcy, sources said.

The network, which is part of publicly-traded Sphere Entertainment, has been in default on $830 million in loans since October and has a forbearance agreement with its lenders that expires Jan. 10.

The debt on that loan is trading at five cents on the dollar, the RSN executive said.

“A full drop would ultimately bankrupt MSG Networks,” media analyst LightShed Partners said in a report this week.

MSGN is losing money party because it is paying $187 million in 2025 to broadcast Knicks and Rangers games as part of a 20-year agreement that ends in 2035, according to public filings.

But the revenue MSGN gets from cable providers, in deals that have much shorter time frames, is falling.

If MSGN was pushed into bankruptcy, it could renegotiate with the Knicks and Rangers and likely pay much lower rights fees to reflect the new RSN market, the RSN executive said.

An MSGN bankruptcy would not necessarily be bad for Dolan, who controls both Sphere Entertainment and Madison Square Garden Sports, the parent company of the Knicks, Rangers and operator of the World’s Most Famous Arena.

He would take a hit from reduced rights fees for the Knicks and Rangers.

But cleaving away MSGN would likely boost Sphere Entertainment, which also includes the $2.3 billion futuristic Las Vegas music mecca.

“This would be good news for Sphere shareholders,” LightShed said. “Removing the $830 million in MSG Networks debt from Sphere’s balance sheet should mean a significant increase in Sphere’s stock price.

MSG Networks declined comment about its financial status.